What role does the Board play?

The Trustees serve as your representatives. They are fiduciaries and have an obligation to approval by shareholders, amendmentsserve the best interests of shareholders. The Trustees review each Fund’s performance, oversee the Trust and the Funds’ activities and review contractual arrangements with companies that provide services to the Investment Advisory Agreements which

would increaseTrust and Funds.

Do Trustees receive compensation for their services?

Each Independent Trustee receives compensation for his service on the advisory fee

3

breakpointsBoard. The Interested Trustees do not receive compensation for their service on the Tocqueville Fund, the Small Cap Value Fund, the

International Value FundBoard. The Proxy Statement provides details about each Nominee and the Gold Fund.

The following table illustrates the advisory fee rates and breakpoints

under the current Investment Advisory Agreements and under the proposed

Investment Advisory Agreements and asset levels as of July 31, 2004:

- -------------------------------------------------------------------------------------------------------------

Current Investment Proposed Investment Asset Level as of

Advisory Fee Rates and Advisory Fee Rates and July 31, 2004

Breakpoints Breakpoints

- -------------------------------------------------------------------------------------------------------------

The Tocqueville Fund annual rate of 0.75% on annual rate of 0.75% on $ 139,957,804

the first $500 million of the first $1 billion of

average daily net assets, average daily net assets,

and 0.65% of average and 0.65% of average

daily net assets in daily net assets in

excess of $500 million excess of $1 billion

- -------------------------------------------------------------------------------------------------------------

The Tocqueville Small Cap annual rate of 0.75% on annual rate of 0.75% on $ 78,557,422

Value Fund the first $500 million of the first $1 billion of

average daily net assets, average daily net assets,

and 0.65% of average and 0.65% of average

daily net assets in daily net assets in

excess of $500 million excess of $1 billion

- -------------------------------------------------------------------------------------------------------------

The Tocqueville annual rate of 1.00% on annual rate of 1.00% on $ 176,900,444

International Value Fund the first $500 million of the first $1 billion of

average daily net assets, average daily net assets,

0.75% of the average and 0.75% of the average

daily net assets in daily net assets in

excess of $500 million excess of $1 billion

but not exceeding $1

billion, and 0.65% of the

average daily net assets

in excess of $1 billion

- -------------------------------------------------------------------------------------------------------------

The Tocqueville annual rate of 1.00% on annual rate of 1.00% on $ 452,399,191

Gold Fund the first $500 million of the first $1 billion of

average daily net assets, average daily net assets,

0.75% of the average and 0.75% of the average

daily net assets in daily net assets in

excess of $500 million excess of $1 billion

but not exceeding $1

billion, and 0.65% of the

average daily net assets

in excess of $1 billion

- -------------------------------------------------------------------------------------------------------------

The only changecompensation to be paid to the Investment Advisory Agreements resulting fromIndependent Trustees.

Who is paying for my shareholder meeting and Proxy Statement?

The Funds will bear the proposed amendments iscosts, fees and expenses incurred in connection with the change in the fee breakpoints. The maximum

advisory fee rates would remain the same. The form of amended Investment

Advisory Agreements are attached to this proxy statement as Exhibit A.

The effect of the proposed amendments to the Investment Advisory

Agreements is that the asset levels at which a breakpoint would become effective

would be higher. The higher breakpoints would

4

increase the amount a Fund would have to pay the Fund's investment adviser once

the current breakpoint levels are reached (e.g., for asset levels in excess of

$500 million but not exceeding $1 billion the advisory fee rate would remain at

the maximum fee rate instead of dropping to the lower fee rate in place under

the current breakpoint structure). Based on current asset levels of the Funds as

of the date of this Proxy Statement there would be no actual impact on the

advisory fees paid by the Funds at this time.

Description of Current Investment Advisory Agreements.

- -----------------------------------------------------Statement. Tocqueville Asset Management L.P. (the "Adviser"“Advisor”), 1675 Broadway, has contractually agreed to limit certain expenses of certain Funds as part of expense limitation agreements and, to the extent that an agreement applies to a Fund, the Advisor will indirectly pay the proxy costs incurred by that Fund.

What is the required vote?

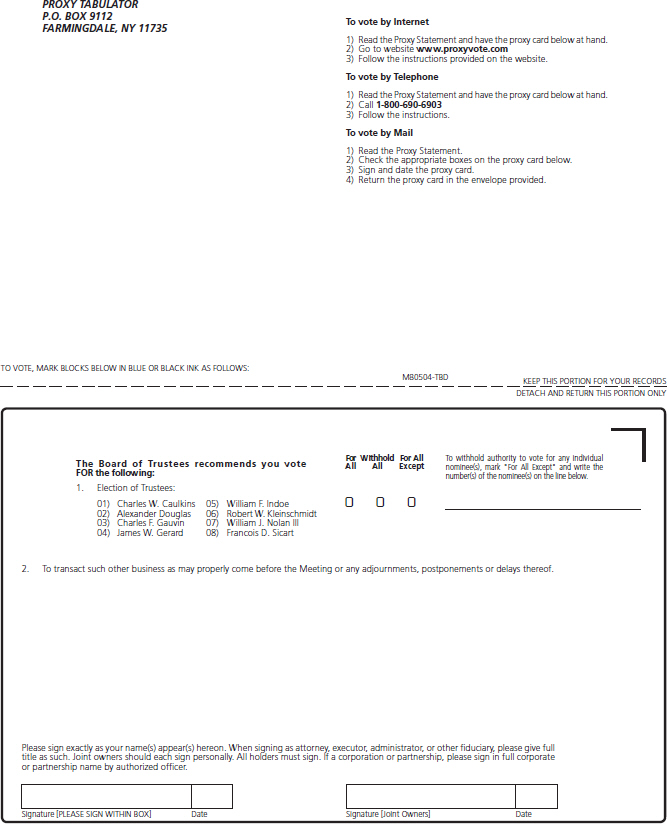

The proposal to elect eight (8) Trustees to the Board requires the affirmative vote of a plurality of the Shares voted at the Meeting in person or by proxy.

How does the Board suggest I vote in connection with the Proposal?

After careful consideration, the Board unanimously recommends that you vote FOR the approval of the Proposal.

How do I vote my Shares?

You can vote in any of the following ways:

Internet: Have your proxy card available. Vote on the Internet by accessing the website address on your proxy card. Enter your control number from your proxy card. Follow the instructions found on the website;

Telephone: Have your proxy card available. You may vote by telephone by calling the number on your proxy card. Enter the control number on the proxy card and follow the instructions provided (A confirmation of your telephone vote will be mailed to you.);

Mail: Vote, sign, date and return the enclosed proxy card in the enclosed postage-paid envelope; or

In Person: You may attend the Meeting and vote in person by filling out a ballot.

When and where will the Meeting be held?

The Meeting will be held at 40 West 57th Street, 19th Floor, New York, New York 10019 acts ason Monday, February 2, 2015, at 10:00 a.m. Eastern Time, and any adjournment or postponement will be held at the investment advisersame location. If you plan to attend the Meeting in person, please RSVP at hbalk@tocqueville.com at least one day prior to the Meeting.

Whom should I call for more information about the Proxy Statement?

For more information regarding the Proxy Statement for the Meeting, please call 1-800-697-3863.

December 24, 2014

THE TOCQUEVILLE TRUST

THE TOCQUEVILLE FUND [TOCQX]

THE TOCQUEVILLE OPPORTUNITY FUND [TOPPX]

THE TOCQUEVILLE INTERNATIONAL VALUE FUND [TIVFX]

THE TOCQUEVILLE GOLD FUND [TGLDX]

THE DELAFIELD FUND [DEFIX]

THE TOCQUEVILLE SELECT FUND [TSELX]

THE TOCQUEVILLE ALTERNATIVE STRATEGIES FUND [TALSX]

40 West 57th Street, 19th Floor

New York, New York 10019

SPECIAL MEETING OF SHAREHOLDERS

To be held on Monday, February 2, 2015

PROXY STATEMENT

This is a Proxy Statement for the above listed funds (each, a “Fund” and collectively, the “Funds”), each of which is a series of The Tocqueville Trust (the “Trust”). Proxies for a Special Meeting of Shareholders of each Fund under separate

Investment Advisory Agreements which provide that the Adviser identify and

analyze possible investments for each Fund, and determine the amount, timing,

and form of those investments. The Adviser has the responsibility of monitoring

and reviewing each Fund's portfolio, on a regular basis, and recommending when

to sell the investments. All purchases and sales by the Adviser of securities in

each Fund's portfolio are subject at all times to the policies set forthbeing solicited by the Board of Trustees.

The current Investment Advisory Agreement betweenTrustees (the “Board,” “Board of Trustees” or the Tocqueville Fund

and the Adviser is dated February 26, 1990, as amended on March 24, 2000, and

was last submitted to shareholders on March 24, 2000, for the purpose of

approving an amendment to the fee breakpoints“Trustees”) of the Investment Advisory

Agreement. Trust to approve a proposal that has already been approved by the Board.

The current Investment Advisory Agreement betweenspecial meeting will be held at the Small Cap Value

Fund and the Adviser is dated June 10, 1994, as amended on March 24, 2000, and

was last submitted to shareholders on March 24, 2000, for the purpose of

approving an amendment to the fee breakpointsoffices of the Investment Advisory

Agreement. The current Investment Advisory Agreement betweenFunds’ investment adviser, Tocqueville Asset Management L.P., 40 West 57th Street, 19th Floor, New York, New York 10019, on Monday, February 2, 2015 at 10:00 a.m. Eastern Time (together with any adjournments or postponements thereof, the International

Value Fund and“Meeting”).

At the Adviser is dated June 10, 1994,Meeting, shareholders of all Funds, voting together as amendeda single class, will be asked:

1. To elect eight Trustees to serve on March 24, 2000,

and was last submitted to shareholders on March 24, 2000, for the purpose of

approving an amendment to the fee breakpoints of the Investment Advisory

Agreement. The current Investment Advisory Agreement between the Tocqueville

Gold Fund and the Adviser is dated June 10, 1998 and has not been submitted to

shareholders since its initial approval by the sole shareholder of the Fund.

On September 18, 2003, the Board of Trustees until their resignation, retirement, death or removal or until their respective successors are duly elected and qualified (the “Proposal”).

2. To transact such other business as may properly come before the Meeting or any adjournments, postponements or delays thereof.

All properly executed proxies received prior to the Meeting will be voted at the Meeting in accordance with the instructions marked on the proxy card. Unless instructions to the contrary are marked on the proxy card, proxies submitted by holders of the Funds’ shares of beneficial interest (“Shares”) will be voted “FOR” the Proposal. The persons named as proxy holders on the proxy card will vote in their discretion on any other matters that may properly come before the Meeting or any adjournments or postponements thereof. Any shareholder executing a proxy has the power to revoke it prior to its exercise by submission of a properly executed, subsequently dated proxy, by voting in person, or by written notice to the Secretary of the Trust unanimously(addressed to the Secretary, The Tocqueville Trust, 40 West 57th Street, 19th Floor, New York, New York 10019). However, attendance at the Meeting, by itself, will not revoke a previously submitted proxy. Unless the proxy is revoked, the Shares represented thereby will be voted in accordance with specifications therein. If you hold Fund shares through a financial intermediary, please consult your financial intermediary regarding your ability to revoke voting instructions.

Only shareholders or their duly appointed proxy holders can attend the Meeting and any adjournment or postponement thereof. Photographic identification and proof of ownership will be required for admission to the Meeting. For directions to the meeting, please contact the Funds at 212-698-0800. If you are planning to attend the Meeting, please RSVP to hbalk@tocqueville.com at least one day prior to the Meeting. If a broker or other nominee holds your Shares and you plan to attend the Meeting, you should bring a recent brokerage statement showing your ownership of the Shares, as well as a form of personal identification. If you are a beneficial owner and plan to vote at the Meeting, you should also bring a proxy card from your broker.

1

The record date for determining shareholders entitled to notice of, and to vote at, the Meeting and at any adjournment or postponement thereof has been fixed at the close of business on December 19, 2014 (the “Record Date”), and each shareholder of record at that time is entitled to cast one vote for each full Share, and a proportionate fractional vote for each fractional Share, registered in his or her name. As of the Record Date, the following number of Shares were outstanding and entitled to be voted:

Fund | Number of Shares | |||

The Tocqueville Fund | 11,531,413 | |||

The Tocqueville Opportunity Fund | 3,615,602 | |||

The Tocqueville International Value Fund | 16,487,730 | |||

The Tocqueville Gold Fund | 37,179,088 | |||

The Delafield Fund | 7,887,159 | |||

The Tocqueville Select Fund | 40,798,149 | |||

The Tocqueville Alternative Strategies Fund | 1,508,274 | |||

Total | 119,007,415 | |||

You should read the entire Proxy Statement before voting. If you have any questions, please call the Funds toll-free at 1-800-697-3863. The Proxy Statement, Notice of Special Meeting and the proxy card(s) are first being mailed to shareholders on or about January 2, 2015.

The most recent Annual and Semi-Annual Reports for the Funds, including financial statements, previously have been furnished to shareholders. If you would like to receive additional copies of these reports free of charge, please write to the The Tocqueville Trust, c/o U.S. Bancorp Fund Services, LLC, 615 East Michigan Street, Milwaukee, Wisconsin 53202 or call toll-free at 1-800-697-3863. The reports also are available on the Fund’s website athttp://www.tocqueville.com/mutual-funds and the website of the Securities and Exchange Commission (“SEC”) atwww.sec.gov.

2

PROPOSAL: ELECTION OF TRUSTEES FOR THE TRUST

The proposal relates to the election of eight (8) Trustees to the Trust’s Board. At a meeting on December 18, 2014, the Board approved the continuationnomination of eight individuals (each a “Nominee,” and collectively, the “Nominees”) for election as Trustees of the Investment Advisory AgreementsTrust. Shareholders are asked to elect the Nominees as Trustees, effective Monday, February 2, 2015 or upon shareholder approval, whichever is later, each to hold office for life until his or her resignation, retirement, death or removal or until his or her respective successor is duly elected and qualified.

The Nominees include Charles W. Caulkins, Alexander Douglas, Charles F. Gauvin, James W, Gerard, William F. Indoe, Robert W. Kleinschmidt, William J. Nolan III, and Francois D. Sicart. Each Nominee, with the exception of Mr. Kleinschmidt and Mr. Sicart, are independent or disinterested persons, which means they are not an “interested person” of the Trust, as defined in the 1940 Act. Such individuals are commonly referred to as “Independent Trustees.” Mr. Kleinschmidt and Mr. Sicart, if elected, would serve as “Interested Trustees.”

The Trust’s Governance and Nominating Committee, which consists solely of Independent Trustees, considered recommendations for Trustees nominees, and considered the qualifications, experience and background of each of the Funds subjectNominees. Based upon this review, the Governance and Nominating Committee recommended each Nominee to the Trust’s Board as a candidate for nomination as an Independent Trustee or Interested Trustee. After discussion and consideration of the matter, the Board voted to nominate the Nominees for election by shareholders. Each Nominee has consented to serve as a Trustee and to being named in this proposal for an additional one-year period.

Reason to Vote ForProxy Statement.

Information about the Proposal.

- -------------------------------

Nominees

The Trustee Nominees and their backgrounds are shown on the following pages. This information includes each Trustee Nominee’s name, age, principal occupation(s) during the past five years and other information about the Trustee Nominee’s professional background, including other directorships the Trustee Nominee holds.

Trustee Nominees

Name, Position(s) Address(1) and Age | Term of | Number of Funds in Fund Complex Overseen by Trustee(3) | Principal Occupation(s) During Past Five Years | Other Directorships Held by Trustee | ||||

INDEPENDENT NOMINEES(4) | ||||||||

Charles W. Caulkins (57) Trustee, Member of the Audit Committee, Member of the Governance and Nominating Committee | Indefinite Term; Since 2003 | 7 | Private Investor from January 2012-present; Partner, Chora Capital, LLC from June 2010-December 2011; Director of Marketing, L.R. Global Partners from January 2008-May 2010; President, Arbor Marketing, Inc. from October 1994-December 2007. | Director, Stepping Stones from January 2012-present; Director, Phoenix House from January 2001-2007. | ||||

Alexander Douglas (66) Trustee, Member of the Audit Committee, Member of the Governance and Nominating Committee | Indefinite Term, Since 2010 | 7 | Retired. Formerly, President, CEO and owner of Spaulding Law Printing, Inc., from 1992-November 2014. | None. | ||||

Name, Position(s) Address(1) and Age | Term of Served(2) | Number of Funds in Fund Complex Overseen by Trustee(3) | Principal Occupation(s) During Past Five Years | Other Directorships Held by Trustee | ||||

Charles F. Gauvin (58) None | New Independent Trustee Nominee | N/A | Executive Director, Maine Audubon, from August 2014-present; Chief Development Officer, Carnegie Endowment for International Peace, from September 2011-May 2014; Partner, The Riparian Fund/Legacy Ranch Partners (private equity real estate fund), from February 2010-December 2012; President and CEO, Trout Unlimited (fish and river conservation), from April 1991-February 2010. | Director, Bioqual, Inc., July 1992- present. | ||||

James W. Gerard (52) Trustee, Member of the Audit Committee, Member of the Governance and Nominating Committee | Indefinite Term, Since 2001 | 7 | Managing Director, North Sea Partners, from January 2010-present; Principal, Juniper Capital Group, LLC (formerly known as Argus Advisors International, LLC) from August 2003-December 2009; Managing Director, The Chart Group from January 2001-present. | Director and Treasurer, American Overseas Memorial Day Association, 1998-present; Director and Treasurer ASPCA, 1998-2008; Trustee, Salisbury School, 2005-present; Director, American Friends of Bleraucourt, 1992- present. | ||||

William F. Indoe (71) Trustee, Member of the Audit Committee, Member of the Governance and Nominating Committee | Indefinite Term, Since December 2006 | 7 | Senior Counsel, Sullivan & Cromwell LLP (attorneys-at-law), from 1968-present. | Director, Rho Capital Partners, Inc., 1990 – present. | ||||

William J. Nolan III (66) Trustee, Member of the Audit Committee, Member of the Governance and Nominating Committee | Indefinite Term, Since December 2006 | 7 | Retired. Formerly, Executive Vice President & Treasurer PaineWebber Inc., from 1997-2001. | Trustee, Adirondack Museum, Blue Mt. Lake, NY 1996-present (Treasurer, 2000-2013; Chair of the Investment Committee, 2009-present). | ||||

4

Name, Position(s) Address(1) and Age | Term of | Number of Funds in Fund Complex Overseen by Trustee(3) | Principal Occupation(s) During Past Five Years | Other Directorships Held by Trustee | ||||

| INTERESTED NOMINEES(5) | ||||||||

Robert W. Kleinschmidt (65) Trustee | Indefinite Term, Since 1991 | 7 | President and Chief Investment Officer of Tocqueville Asset Management; Director, Tocqueville Management Corporation, the General Partner of Tocqueville Asset Management L.P. and Tocqueville Securities L.P. from January 1994 -present; and Managing Director from July 1991-January 1994; Partner, David J. Greene & Co. from May 1978-July 1991. | President and Director, Tocqueville Management Corporation, the General Partner of Tocqueville Asset Management L.P. and Tocqueville Securities L.P. | ||||

François D. Sicart (70) Trustee | Indefinite Term, Since 1987 | 7 | Chairman, Tocqueville Management Corporation, the General Partner of Tocqueville Asset Management L.P. and Tocqueville Securities L.P. from January 1990-present; Chairman and Founder, Tocqueville Asset Management Corporation from December 1985-January 1990; Vice Chairman of Tucker Anthony Management Corporation from 1981-October 1986; Vice President (formerly general partner) among other positions with Tucker Anthony, Inc. from 1969-January 1990. | Chairman and Director, Tocqueville Management Corporation, the General Partner of Tocqueville Asset Management L.P. and Tocqueville Securities L.P. from January 1990-present. | ||||

5

| (1) | Address: 40 West 57th Street, 19th Floor, New York, New York, 10019, unless otherwise noted. |

| (2) | Each Trustee will hold office for an indefinite term until the earliest of (i) the next meeting of shareholders, if any, called for the purpose of considering the election or re-election of such Trustee and until the election and qualification of his or her successor, if any, elected at such meeting, or (ii) the date a Trustee resigns or retires, or a Trustee is removed by the Board of Trustees or shareholders, in accordance with the Trust’s By-Laws, as amended, and Agreement and Declaration of Trust, as amended. Each officer will hold office for an indefinite term until the date he or she resigns or retires or until his or her successor is elected and qualifies. |

| (3) | The Fund Complex is comprised of The Tocqueville Fund, The Tocqueville Opportunity Fund, The Tocqueville International Value Fund, The Tocqueville Gold Fund, The Delafield Fund, The Tocqueville Select Fund, and The Tocqueville Alternative Strategies Fund. |

| (4) | Trustees who are not considered to be “interested persons” of the Trust as defined in the 1940 Act are considered to be “Independent Trustees.” |

| (5) | Trustees who are considered to be “interested persons” of the Trust as defined in the 1940 Act are considered to be “Interested Trustees.” Mr. Kleinschmidt and Mr. Sicart are considered “interested persons” because of their affiliation with the Advisor. |

Additional Information about the Board of Trustees and Trustee Nominees

The Role of the Board

The Board of Trustees (the “Board”) oversees the management and operations of the Tocqueville Trust (the “Trust”). Like most mutual funds, the day-to-day management and operation of the Fund is performed by various service providers to the Trust, such as the Trust’s Advisor, distributor, custodian, and sub-Administrator.

The Board has appointed senior employees of the Advisor as officers of the Trust, unanimously recommends thatwith responsibility to monitor and report to the shareholders ofBoard on the Tocqueville Fund, the Small Cap Value Fund, the

International Value FundTrust’s operations. The Board receives quarterly reports from these officers and the Gold Fund voteTrust’s service providers regarding the Trust’s operations and more frequent reporting of issues identified by the officers as appropriate for immediate Board attention. The Advisor provides periodic updates to approve an amendment to each

respective Fund's Investment Advisory Agreement to increase the advisory fee

breakpoints for these Funds.

In determining whether to approve the amended Investment Advisory

Agreements, the Board consideredregarding general market conditions and the scopeimpact that these market conditions may have on the Fund. The Board has appointed a Chief Compliance Officer who administers the Trust’s compliance program and quality of services provided by

the Adviser and particularly the personnel responsible for providing servicesregularly reports to the Funds.Board as to compliance matters. Some of these reports are provided as part of formal “Board Meetings” which are typically held quarterly, in person, and involve the Board’s review of recent Trust operations. The Board also reviewed financial data onholds special meetings when necessary and from time to time one or more members of the Adviser's profitability

relatingBoard may also consult with management in less formal settings, between scheduled “Board Meetings”, to itsdiscuss various topics. In all cases, however, the role of the Board and of any individual Trustee is one of oversight and not of management of the Funds. day-to-day affairs of the Trust and its oversight role does not make the Board a guarantor of the Fund’s investments, operations or activities.

6

Board Structure, Leadership

The Board also focusedhas structured itself in a manner that it believes allows it to perform its oversight function effectively. It has established two standing committees, an Audit Committee and a Governance and Nominating Committee, which are discussed in greater detail under “Board Committees” below. If all of the Nominees are elected, 75% of the members of the Board will be Independent Trustees. Each of the Audit and Governance and Nominating Committees is comprised entirely of Independent Trustees. The Chairman of the Board has been chairman of the Advisor for over 23 years. The Independent Trustees help identify matters for consideration by the Board. The Board reviews its structure annually. In developing its structure, the Board has considered that the Chairman of the Board, as chairman of the Advisor, can provide valuable input based on the Adviser's

reputation and long-standing relationshiphis tenure with the Funds. In addition, the Board

discussed the Adviser's track record of monitoring the Funds to assure that the

Funds have been in compliance with their investment policiesAdvisor and restrictions

and also to assure that they have been in compliance with the requirements of

the 1940 Act and related securities regulations.

Performance and Expenses of the Funds:

The Board's analysis of the Funds' performance and expenses included

discussion and review of the following materials: (i) performance data of the

Funds and funds that have a similar investment objective and that are of

comparable size (the "Peer Groups"), (ii) performance data of the Funds compared

to relevant stock indices, and (iii) data concerning the fees and expenses of

the Funds compared to their

5

Peer Groups. In particular, the Board noted that the Funds had consistently

performed wellexperience in the last year, generally outperforming their benchmarks and

that the overall expense ratiostypes of the Funds were in line with their Peer

Groups. In particular, as of April 30, 2004, with respect to the one-year

average annual returns, The Tocqueville Fund had returned 39.05%, outperforming

the S&P 500 Index which returned 22.88%; The Small Cap Value Fund had returned

60.45%, outperforming the Russell 2000 Index which had returned 42.01%; The

International Value Fund had returned 60.90%, outperforming the Morgan Stanley

EAFE Index which had returned 40.75%; and The Gold Fund had returned 37.37%,

outperforming the S&P 500 Index and the Philadelphia Stock Exchange Gold &

Silver Index which had returned 22.88% and 26.86%, respectively. The Board

considered the fact that the advisory fees of all Funds, with the exception of

the Gold Fund, were in line with the average of what the Peer Group was charging

based on Peer Group data and additional breakpoint data provided by the Adviser.

The Board further observed that, even though the Gold Fund's advisory fee was on

the higher end of the Peer Group scale, the Fund's performance was generally

above that of its Peer Group. The Board also acknowledged the specialized

knowledge required to manage the Gold Fund due to the nature of the securities in which the Fund invests. Other Factors:

The Board has also determined that the function and composition of the Audit and Governance and Nominating Committees are appropriate means to provide effective oversight on behalf of Trust shareholders and address any potential conflicts of interest that may arise from the Chairman’s status as an Interested Trustee.

Board Oversight of Risk Management

The Board of Trustees oversees various elements of risk relevant to the business of the Trust. Risk is a broad category that covers many areas, including, without limitation, financial and investment risk, compliance risk, business and operational risk and personnel risk. The Board and its Committees receive and review various reports on such risk matters and discuss the results with appropriate management and other personnel. Because risk management is a broad concept comprised of many elements, Board oversight of different types of risks is handled in different ways. For example, the Audit Committee meets regularly with the Treasurer and the Trust’s independent public accounting firm and, when appropriate, with other personnel of the Advisor to discuss, among other things, the internal control structure of the Trust’s financial reporting function as well as other accounting issues. The Independent Trustees meet with the Chief Compliance Officer to discuss compliance risks relating to the Trust, the Advisor and the other service providers. In addition, one of the Independent Trustees is a member of the Trust’s Valuation Committee. The full Board receives reports from the Advisor as to investment risks as well as other risks. The full Board also receives reports from the Audit Committee regarding the risks discussed during the committee meetings. Further, the Board discusses operational and administrative risk issues with the officers of the Trust who are also senior personnel of the Advisor.

Information about Each Trustee’s Qualification, Experience, Attributes or Skills

The Board believes that each of the Trustees has the qualifications, experience, attributes and skills (“Trustee Attributes”) appropriate to their continued service as a Trustee of the Trust in light of the Trust’s business and structure. In addition to a demonstrated record of business and/or professional accomplishment, most of the Trustees have served on boards for organizations other than the Trust, and have served on the Board for a number of years. They therefore have substantial board experience and, in their service to the Trust, have gained substantial insight as to the operation of the Trust and have demonstrated a commitment to discharging oversight duties as trustees in the interests of shareholders. The Board annually conducts a “self-assessment” wherein the effectiveness of the Board and individual Trustees is reviewed. In conducting its annual self-assessment, the Board has determined that the Trustees have the appropriate attributes and experience to continue to serve effectively as Trustees of the Trust.

In addition to the information provided in the charts above, factors,certain additional information regarding the Trustees and their Trustee Attributes is provided below. The information is not all-inclusive. Many Trustee Attributes involve intangible elements, such as intelligence, integrity and work ethic, along with the ability to work together, to communicate effectively, to exercise judgment and ask incisive questions, and commitment to shareholder interests.

Mr. Caulkins is experienced with investment and regulatory matters through his former position as a Partner at Chora Capital, an investment firm, as well as from his prior experiences as a Marketing Manager at L.R. Global Partners, a money management firm and the President of Arbor Marketing, Inc. In addition, Mr. Caulkins has experience serving on the boards of several nonprofit organizations and, in serving on these boards, Mr. Caulkins has come to understand and appreciate the role of a director and has been exposed to many of the challenges facing a board and the appropriate ways of dealing with those challenges. Mr. Caulkins has over 10 years of experience on the Board of the Trust and therefore understands the regulation, management and oversight of mutual funds.

7

Mr. Douglas has over 20 years of experience as the former President, CEO and owner of Spaulding Law Printing, Inc. and understands the various aspects and challenges involved in running a corporation.

Mr. Gauvin has over 20 years of experience as a CEO and is well versed in managing a wide array of businesses and investment risks. Mr. Gauvin also discussedhas experience serving as a director for a life science research company and, in serving on this board, Mr. Gauvin has come to understand and appreciate the Adviser's practices regardingrole of a director and has been exposed to many of the selectionchallenges facing a board and compensationthe appropriate ways of brokersdealing with these challenges.

Mr. Gerard is experienced with financial, investment and dealers that execute portfolio transactionsregulatory matters through his position as a Managing Director of North Sea Partners, as well as from his prior position as the Principal at Juniper Capital Group, LLC. Mr. Gerard has experience serving on the boards of numerous nonprofit organizations and, in serving on these boards, Mr. Gerard has come to understand and appreciate the role of a director and has been exposed to many of the challenges facing a board and the appropriate ways of dealing with those challenges. Mr. Gerard has over 12 years of experience on the Board of the Trust and therefore understands the regulation, management and oversight of mutual funds. Mr. Gerard also serves as an Audit Committee Financial Expert for the FundsTrust and is the Trustee representative on the Trust’s Valuation Committee.

Mr. Indoe is an attorney, with a practice focusing on tax and investment matters. Mr. Indoe also has experience serving as a director for a private equity firm, as well as prior experience on the Board of a predecessor mutual fund, and in serving on these boards, Mr. Indoe has come to understand and appreciate the role of a director and has been exposed to many of the challenges facing a board and the brokers'appropriate ways of dealing with those challenges. Mr. Indoe has over 7 years of experience on the Board of the Trust and dealers' provisiontherefore understands the regulation, management and oversight of brokeragemutual funds.

Mr. Nolan is experienced with financial, investment and research servicesregulatory matters through his former position as an Executive Vice President and Treasurer for PaineWebber Inc. Mr. Nolan also served on the Board of Directors of the Public Securities Association (a predecessor of the Securities and Financial Markets Association) from 1988 to 1991. Additionally, Mr. Nolan has experience serving on the board of a nonprofit organization and, in serving on this board, Mr. Nolan has come to understand and appreciate the role of a director and has been exposed to many of the challenges facing a board and the appropriate ways of dealing with those challenges. Mr. Nolan has over 7 years of experience on the Board of the Trust and therefore understands the regulation, management and oversight of mutual funds. Mr. Nolan also serves as Audit Committee Chair and as an Audit Committee Financial Expert for the Trust.

Mr. Sicart is chairman of the Advisor. As chairman of the Advisor, Mr. Sicart has intimate knowledge of the Advisor and the Trust, its operations, personnel and financial resources. His position of responsibility at the Advisor, in addition to his knowledge of the firm, has been determined to be valuable to the Adviser (including

transactions processed through affiliates of the Adviser).

The Board determined that the proposed fees to be payable under the

amended Investment Advisory Agreements were fair and reasonable with respect to

the services that the Adviser provides and in light of the other factors

described above that the Board deemed relevant. The Board based its decision on

an evaluation of all these factors as a whole and did not consider any one

factor as all-important or controlling.

Trustees Recommendation. The trustees unanimously recommend that shareholders

approve the proposed amendments to the Investment Advisory Agreements to

increase the advisory fee breakpoints. If this proposal is not approved, the

current advisory fee breakpoints will remain in effect.

The favorable vote of a "majority of the outstanding voting

securities," as defined in the 1940 Act, of each Fund is required for the

approval of this proposal. The vote of the holders of a majority (as so defined)

of outstanding voting securities means the vote of (l) the holders of 67% or

more of the Shares of each Fund represented at the Meeting, if more than 50% of

the Shares each Fund are represented at the Meeting, or (2) more than 50% of the

outstanding Shares of each Fund, whichever is less.

The trustees unanimously recommend that the shareholders of the Funds

vote in favor of Proposal 2.

6

Information About the Adviser, Administrator and Distributor.

- ------------------------------------------------------------

The following individuals are general partners and/or principal

executive officers of the Adviser:

- -------------------------------------------------------------------------------------------------------------

Name and Address Principal Occupation

- -------------------------------------------------------------------------------------------------------------

Francois D. Sicart Founder, Tocqueville Management Corporation, the

1675 Broadway General Partner of Tocqueville Asset Management

New York, New York 10019 L.P. and Lepercq, de Neuflize/Tocqueville

Securities, L.P.

- -------------------------------------------------------------------------------------------------------------

Robert Kleinschmidt President, Chief Investment Officer and Director,

1675 Broadway Tocqueville Management Corporation and President,

New York, New York 10019 Tocqueville Asset Management L.P.

- -------------------------------------------------------------------------------------------------------------

Elizabeth F. Bosco Compliance Officer, Tocqueville Asset Management

1675 Broadway L.P.

New York, New York 10019

- -------------------------------------------------------------------------------------------------------------

Roger Cotta Chief Operating Officer, Tocqueville Asset

1675 Broadway Management L.P.

New York, New York 10019

- -------------------------------------------------------------------------------------------------------------

Tocqueville Management Corporation, N/A

General Partner

1675 Broadway

New York, New York 10019

- -------------------------------------------------------------------------------------------------------------

Francois Sicart, Robert Kleinschmidt, Elizabeth Bosco and Roger Cotta are also

trustees and/or officersoversight of the Trust. ForMr. Sicart has over 26 years of experience on the Board of the Trust and therefore understands the regulation, management and oversight of mutual funds.

Mr. Kleinschmidt is the President and Chief Investment Officer of the Advisor. As President and Chief Investment Officer of the Advisor, Mr. Kleinschmidt has intimate knowledge of the Advisor and the Trust, its operations, personnel and financial resources. His position of responsibility at the Advisor, in addition to his knowledge of the firm, has been determined to be valuable to the Board in its oversight of the Trust. Mr. Kleinschmidt has over 22 years of experience on the Board of the Trust and therefore understands the regulation, management and oversight of mutual funds.

Board Meetings

The Trust’s Board held four regular meetings and two special meetings during the fiscal year ended October 31, 2003, the Adviser received

advisory fees from the Funds under the Investment Advisory Agreements as

follows: the Tocqueville Fund: $559,545 (of which amount $51,169 was waived);

the Small Cap Value Fund: $460,594; the International Value Fund: $916,873; and

the Gold Fund: $2,343,663. If the proposed increased advisory fee breakpoints

had been in effect for the fiscal year ended October 31, 2003, the fees paid by

the Funds to the Adviser would not have been affected. These services will

continue to be provided after the amendments to the Investment Advisory

Agreements are approved.

The Adviser also acts as investment adviser for The Tocqueville Alexis

Trust (the "Alexis Trust") which has a similar investment objective to The

Tocqueville Fund. Pursuant to an investment advisory agreement between the

Alexis Trust and the Adviser, the Alexis Trust pays to the Adviser an investment

advisory fee, accrued daily and payable monthly in arrears, at an annual rate of

0.60% of the Alexis Trust's average daily net assets. For the fiscal year ended

October 31, 2003, the Alexis Trust paid investment advisory fees of $401,919 to

the Adviser.

The Adviser also acts as the Trust's administrator and supervises

administration of the Funds pursuant to an Administrative Services Agreement.

Under the Administrative Services Agreement, the Adviser supervises the

administration of all aspects of each Fund's operations, including each Fund's

receipt of services for which the Fund is obligated to pay, provides the Funds

with general office facilities and provides, at each Fund's expense, the

services of persons necessary to perform such supervisory, administrative and

clerical functions as are needed to effectively operate the Funds. For these

services and facilities, the Adviser receives a fee computed and paid monthly at

an annual rate of 0.15% of the average

7

daily net assets of each Fund. For the fiscal year ended October 31, 2003, the

Adviser received administrative fees under the Administrative Services Agreement

as follows: the Tocqueville Fund: $111,909; the Small Cap Value Fund: $92,119;

the International Value Fund: $137,531; and the Gold Fund: $351,550. It is

currently intended that the Adviser will continue to provide these services

after the amendments to the Investment Advisory Agreements are approved.

Lepercq, de Neuflize/Tocqueville Securities, L.P. (the "Distributor"),

an affiliate of the Adviser, located at 1675 Broadway, New York, New York 10019,

serves as the Fund's distributor and principal underwriter pursuant to the

amended Distribution Agreement dated September 30, 2003. For the fiscal year

ended October 31, 2003, the Distributor received fees under the Distribution

Agreement as follows: the Tocqueville Fund: $186,515; the Small Cap Value Fund:

$153,531; the International Value Fund: $229,218; and the Gold Fund: $585,916.

It is currently intended that the Distributor will continue to provide these

services after the amendments to the Investment Advisory Agreements are

approved.

For the fiscal year ended October 31, 2003, the brokerage commissions

paid by the Funds to the Distributor were as follows: the Tocqueville Fund:

$110,593; the Small Cap Value Fund: $159,738; the International Value Fund:

$56,262; and the Gold Fund: $327,731. For the fiscal year ended October 31,

2003, the percentage of each Fund's brokerage commissions paid to the

Distributor were as follows: the Tocqueville Fund: 64%; the Small Cap Value

Fund: 39%; the International Value Fund: 19%; and the Gold Fund: 26%.

PROPOSAL 3. ELECTION OF TRUSTEES.

Description of Proposal.

- -----------------------

At the meeting, eight trustees are to be elected, each to hold office

until his or her successor has been elected and qualified. All such persons have

consented to be named in this Proxy Statement and to continue to serve as

trustees of the Trust if elected. Ms. Lucille Bono, Mr. Guy A. Main, Ms. Inge

Heckel, Mr. Larry Senderhauf, Mr. Francois Sicart and Mr. Robert Kleinschmidt

were elected by shareholders through earlier proxies and currently serve as

trustees of the Trust. Mr. Charles W. Caulkins was selected and nominated by the

Board's nominating committee and elected by the full Board on September 18,

2003. Mr. James W. Gerard was elected by the full Board at a meeting held on

June 14, 2001. Mr. Caulkins and Mr. Gerard currently serve as trustees of the

Trust.2014. During the fiscal year ended October 31, 2003, the Board of Trustees met

five times, and2014, each trusteecurrent Trustee attended at least 75% of the board meetings.

Information Aboutmeetings of the Trust's Audit Committee.

- ---------------------------------------------

Trust’s Board of Directors.

8

Board Committees

The TrustBoard has an Audit Committee that meets at least annually to select, oversee and set the compensation of the Trust'sTrust’s independent registered public accounting firm.firm (the “accountants”). The Audit Committee is responsible for pre-approving all audit and non-audit services performed by the independent registered public

accounting firmaccountants for the Trust and for pre-approving certain non-audit services performed by the independent registered public accounting firmaccountants for the AdviserAdvisor and certain control persons of the Adviser.Advisor. The Audit Committee also meets with the Trust's independent registered public accounting firmTrust’s accountants to review the Trust'sTrust’s financial statements and to report on its findings to the Board, and to provide the independent registered public accounting firmaccountants the opportunity to report on various other matters. The Audit Committee also acts as the Trust'sTrust’s qualified legal compliance committee. The members of the Audit Committee is currently comprised of

Lucille G. Bono, Guy A. Main, Inge Heckel, Larry M. Senderhauf,are Charles W. Caulkins, andAlexander Douglas, James W. Gerard, who are disinterested trustees. William F. Indoe and William J. Nolan III. If elected, Mr. Gauvin will also be a member of the Audit Committee. Mr. Nolan serves as Chairman of the Audit Committee.

The Audit Committee

met twice during the fiscal year ended October 31, 2003.

Information About the Trust's Nominating Committee.

- --------------------------------------------------

The TrustBoard has a Governance and Nominating Committee currently comprised of Lucille G.

Bono, Guy A. Main, Inge Heckel, Larry M. Senderhauf, Charles W. Caulkins, andAlexander Douglas, James W. Gerard, who are disinterested trustees,William F. Indoe and William J. Nolan III to whose discretion the selection and nomination of trustees who are not "interested“interested persons,"” as defined in the 1940 Act, of

8

TheIf elected, Mr. Gauvin will also be a member of the Governance and Nominating Committee met once during the fiscal year

ended October 31, 2003. The Nominating Committee has a charter, which although

not available on the Trust's website, is attached to this proxy statement as

Exhibit B.Committee. This Committee currently does notwill consider nomineesany candidate for Trustee recommended by shareholders unlessa current shareholder if the committeeCommittee is required by law to do so. Any such

recommendation must contain sufficient background information concerning the

candidate to enable the Committee to make a proper judgment as to the

candidate's qualifications. Any such recommendations must be submitted in

writing and addressed to the Committee at the Trust's offices.

The Committee has not established specific, minimum qualifications that

must be met by an individual for the Nominating Committee to recommend that

individual for nomination as a Trustee, however, in evaluating candidates, the

Nominating Committee generally considers various factors. (See the Nominating

Committee Charter attached to this proxy statement as Exhibit B for a list of

such factors).

Shareholders may send communications to the Board by writing the

Secretary of the Trust, Roger Cotta, at 1675 Broadway, 16th Floor, New York, New

York 10019.

The Trust does not have a policy regarding Board member's attendance at

annual shareholder meetings because the Trust does not currently hold annual

meetings of shareholders.

The election of each trustee requires the approval of a plurality

present at the Meeting in person or by proxy.

9

Information About the Trustees.

- ------------------------------

The following is a list of the current members of the Board of Trustees

and officers of the Trust, including the principal occupation of each trustee,

nominee and officer. The mailing address for each individual is 1675 Broadway,

New York, NY 10019, unless otherwise provided.

The trustees and officers and their principal occupations are noted below.

Number of

Funds in

Fund

Term of Office Complex

Position(s) Held and Length of Principal Occupation(s) Overseen Other Directorships

Name, Age and Address with the Trust Time Served(1) During Past Five Years By Trustee Held by Trustee

- ----------------------- ------------------ ---------------- --------------------------------- ------------- ------------------------

DISINTERESTED TRUSTEES

- ----------------------

Lucille G. Bono (70) Trustee Since 1998 Retired. Formerly, 5 None

1675 Broadway Financial Services

New York, NY 10019 Consultant from 1997 to

2000; Operations and

Administrative Manager,

Tocqueville Asset

Management, L.P. and

Tocqueville Securities,

L.P. from January 1995

to November 1997.

Charles W. Caulkins (47) Trustee Since 2003 Founder and President, 5 Director, Phoenix

Arbor Marketing Inc. Arbor Marketing, Inc. House from

300 Rockefeller Plaza, from October 1994 to January 2001 to

#5432 present. present;

New York, NY 10112 Director, Bridges

2 Community from

July 2002 to

present.

James W. Gerard (42) Trustee Since 2001 Principal, Argus 5 Vice Chairman and

Argus Advisors Advisor International Treasurer, ASPCA

International LLC from August 2003 to from 1997 to

36 West 44th Street, present; Managing present;

Suite 610 Director, The Chart Director, Phoenix

New York, NY 10036 Group from January 2001 House from 1995

to present; Managing to present;

Principal, Ironbound Member of

Partners from October Supervisory

1998 to December 2000; Board, Hunzinger

Director of Sales and Information AG

Marketing, Tocqueville from November

Asset Management L.P. 2003 to June 2004.

from 1993 to 1998.

________________________________

1 Each trustee will hold officeThe mailing address for an indefinite term until the

earliest of (i) the next meeting of shareholders, if any, called for the purpose

of considering the election or re-election of such trusteeeach Trustee and until the

election and qualification of his or her successor, if any, elected at such

meeting, or (ii) the date a Trustee resigns or retires, or a trusteeofficer is removed

by the Board of Trustees or shareholders, in accordance with the Trust's

By-Laws, as amended, and Agreement and Declaration of Trust, as amended. Each

officer will hold office for an indefinite term until the date he or she resigns

or retires or until his or her successor is elected and qualifies.

10

Number of

Funds in

Fund

Term of Office Complex

Position(s) Held and Length of Principal Occupation(s) Overseen Other Directorships

Name, Age and Address with the Trust Time Served(1) During Past Five Years By Trustee Held by Trustee

- ----------------------- ------------------ ---------------- --------------------------------- ------------- ------------------------

Inge Heckel (64) Trustee Since 1987 President, New York 5 Director, Sir

1675 Broadway School of Interior John Soane Museum

New York, NY 10019 Design, from July 1996 Foundation;

to present. Member of the

Advisory Council,

the Institute of

Classical

Architecture;

Member, Advisory

Council, Olana

Partnership

Guy A. Main (67) Trustee Since 2000 Retired. Formerly, 5

1675 Broadway Executive Vice

New York, NY 10019 President, Amwest

Insurance Group, Inc.

from April 1996 to

January 2001.

Chairman, President and

Chief Executive

Officer, Condor

Services Inc. from

April 1989 to April

1996.

Larry M. Senderhauf (55) Trustee Since 1998 Retired. Administrator 5 None

1675 Broadway and Trustee, LMS 33

New York, NY 10019 Profit and Pension

Sharing Fund from

1983 to 2004.

________________________________

1 Each trustee will hold office for an indefinite term until the

earliest of (i) the next meeting of shareholders, if any, called for the purpose

of considering the election or re-election of such trustee and until the

election and qualification of his or her successor, if any, elected at such

meeting, or (ii) the date a Trustee resigns or retires, or a trustee is removed

by the Board of Trustees or shareholders, in accordance with the Trust's

By-Laws, as amended, and Agreement and Declaration of Trust, as amended. Each

officer will hold office for an indefinite term until the date he or she resigns

or retires or until his or her successor is elected and qualifies.

11

Number of

Funds in

Fund

Term of Office Complex

Position(s) Held and Length of Principal Occupation(s) Overseen Other Directorships

Name, Age and Address with the Trust Time Served(1) During Past Five Years By Trustee Held by Trustee

- ----------------------- ------------------ ---------------- --------------------------------- ------------- ------------------------

INTERESTED TRUSTEES(2) AND OFFICERS

- -----------------------------------

Francois D. Sicart (60) Chairman, Since 1987 Founder, Tocqueville 5 Chairman and

1675 Broadway Principal Management Corporation, Director,

New York, NY 10019 Executive the General Partner of Tocqueville

Officer and Tocqueville Asset Management

Trustee Management L.P. and Corporation, the

Lepercq, de Neuflize/ General Partner

Tocqueville Securities, of Tocqueville

L.P. from January 1990 Asset Management

to present; Chairman L.P. and Lepercq,

and Chief Executive de

Officer, Tocqueville Neuflize/Tocqueville

Asset Management Corp. Securities, L.P.

from December 1985 to from January 1990

January 1990; Vice to present;

Chairman of Tucker Director,

Anthony Management Lepercq-Amcur

Corp. from 1981 to from 1988 to

October 1986; Vice present;

President (formerly Director, Banque

general partner) among Transatlantique

other positions with from December

Tucker Anthony, Inc. 1998 to present.

from 1969 to January

1990.

Robert Kleinschmidt (54) President, Since 1991 President, Chief 5 Director,

1675 Broadway Principal Investment Officer and Tocqueville

New York, NY 10019 Operating Director, Tocqueville Management

Officer, Management Corporation Corporation, the

Principal and President, General Partner

Financial Tocqueville Asset of Tocqueville

Officer, and Management L.P. from Asset Management

Trustee January 1994 to L.P. and Lepercq,

present; and Managing de

Director from July 1991 Neuflize/Tocqueville

to January 1994; Securities, L.P.

Partner, David J.

Greene & Co. from May

1978 to July 1991.

Roger Cotta (65) Secretary, Secretary Since Chief Operating N/A N/A

1675 Broadway Treasurer 2001; Treasurer Officer, Tocqueville

New York, NY 10019 Since 2002 Asset Management L.P.

from 2001 to present;

CFO & Compliance

Officer, Needham & Co.

from 1992 to 2001.

_____________________________________

1 Each trustee will hold office for an indefinite term until the

earliest of (i) the next meeting of shareholders, if any, called for the purpose

of considering the election or re-election of such trustee and until the

election and qualification of his or her successor, if any, elected at such

meeting, or (ii) the date a Trustee resigns or retires, or a trustee is removed

by the Board of Trustees or shareholders, in accordance with the Trust's

By-Laws, as amended, and Agreement and Declaration of Trust, as amended. Each

officer will hold office for an indefinite term until the date he or she resigns

or retires or until his or her successor is elected and qualifies.

2 "Interested person"40 West 57th Street, 19th Floor, New York, NY 10019.

Share Ownership of the Trust is definedAdvisor, Distributor or Affiliates

As of November 30, 2014, neither the Independent Trustees nor members of their immediate family, own securities beneficially or of record in the 1940 Act. Mr. Sicart

and Mr. Kleinschmidt are considered "interested persons" becauseAdvisor, Tocqueville Securities, L.P., the Funds’ distributor (the “Distributor”), or an affiliate of the Advisor or Distributor. Accordingly, neither the Independent Trustees nor members of their affiliation withimmediate family, have direct or indirect interest, the Adviser.

12

Number of

Fundsvalue of which exceeds $120,000, in

Fund

Term of Office Complex

Position(s) Held and Length of Principal Occupation(s) Overseen Other Directorships

Name, Age and Address with the Trust Time Served(1) During Past Five Years By Trustee Held by Trustee

- ----------------------- ------------------ ---------------- --------------------------------- ------------- ------------------------

Elizabeth Bosco (56) Compliance Since 2002 Compliance Officer, N/A N/A

1675 Broadway Officer Tocqueville Asset

New York, NY 10019 Management L.P. from

1997 to present.

_____________________________________

1 Each trustee will hold office for an indefinite term until the earliestAdvisor, the Distributor or any of (i)their affiliates. In addition, during the next meetingtwo most recently completed calendar years, neither the Independent Trustees nor members of shareholders, iftheir immediate families have conducted any called fortransactions (or series of transactions) in which the purposeamount involved exceeds $120,000 and to which the Advisor, the Distributor or any affiliate thereof was a party.

Share Ownership of considering the election or re-election of such trustee and until the

election and qualification of his or her successor, if any, elected at such

meeting, or (ii) the date a Trustee resigns or retires, or a trustee is removed

by the Board of Trustees or shareholders, in accordance with the Trust's

By-Laws, as amended, and Agreement and Declaration of Trust, as amended. Each

officer will hold office for an indefinite term until the date he or she resigns

or retires or until his or her successor is elected and qualifies.

13

The following table showsbelow sets forth the dollar range of equity securities of each Fund shares beneficially owned as of November 30, 2014 by each trusteeTrustee standing for election at the Meeting. As of November 30, 2014, the Trustees and officers as a group owned beneficially 7.48% of July 31, 2004:

the Tocqueville Fund’s outstanding shares, 8.92% of the Tocqueville Opportunity Fund’s outstanding shares, 2.87% of the Tocqueville International Value Fund’s outstanding shares, 0.13% of the Tocqueville Gold Fund’s outstanding shares, 0.27% of the Delafield Fund’s outstanding shares, 1.65% of the Tocqueville Select Fund’s outstanding shares, and 2.27% of the Tocqueville Alternative Strategies Fund’s outstanding shares.

9

Name of Trustee | Name of Fund | Dollar Range of Equity Securities in each Fund | Aggregate Dollar Range of Equity Securities in All Registered Investment Companies Overseen or to be Overseen by Nominee in Family of Investment Companies | |||

| INDEPENDENT NOMINEES: | ||||||

| Charles W. Caulkins | Tocqueville Fund Opportunity Fund International Value Fund Gold Fund The Delafield Fund The Select Fund The Tocqueville Alternative Strategies Fund | Over $100,000 $10,001 - $10,001 - $1 - $10,000 None $10,001 - $50,000 None | Over $100,000 | |||

| Alexander Douglas | Tocqueville Fund Opportunity Fund International Value Fund Gold Fund The Delafield Fund The Select Fund The Tocqueville Alternative Strategies Fund | Over $100,000 None $50,001 - $50,001 - $100,000 $50,001 - $100,000 None Over $100,000 | Over $100,000 | |||

| Charles F. Gauvin | Tocqueville Fund Opportunity Fund International Value Fund Gold Fund The Delafield Fund The Select Fund The Tocqueville Alternative Strategies Fund | None None None None None None None | None | |||

| James W. Gerard | Tocqueville Fund Opportunity Fund International Value Fund Gold Fund The Delafield Fund The Select Fund The Tocqueville Alternative Strategies Fund | Over $100,000 $10,001 - Over $100,000 Over $100,000 $10,001 - Over $100,000 $10,001 - $50,000 | Over $100,000 | |||

| William F. Indoe | Tocqueville Fund Opportunity Fund International Value Fund Gold Fund The Delafield Fund The Select Fund The Tocqueville Alternative Strategies Fund | Over $100,000 None None None None Over $100,000 None | Over $100,000 | |||

| William J. Nolan III | Tocqueville Fund Opportunity Fund International Value Fund Gold Fund The Delafield Fund The Select Fund The Tocqueville Alternative Strategies Fund | Over $100,000 $10,001 - $50,000 $10,001 - $50,000 None $10,001 - $50,000 None None | Over $100,000 | |||

10

| INTERESTED NOMINEES: | ||||||

| Robert W. Kleinschmidt | Tocqueville Fund Opportunity Fund International Value Fund Gold Fund The Delafield Fund | |||||

| Over $100,000 Over $100,000 Over $100,000 Over $100,000 Over $100,000 Over $100,000 Over $100,000 | Over $100,000 | |||||

| Francois D. Sicart | Tocqueville Fund Opportunity Fund International Value Fund Gold Fund The Delafield Fund The Select Fund The Tocqueville Alternative Strategies Fund | Over $100,000 Over $100,000 Over $100,000 Over $100,000 Over $100,000 None None | Over $100,000 | |||

Trustee Compensation.

- --------------------

and Officer Compensation

The Trust does not pay direct remuneration to any officer of the Trust. For the fiscal year ended October 31, 2003,2014, the Trust paidreimbursed the disinterested

trustees an aggregate of $31,500. Each disinterested trustee received $1,500 per

Board meeting and $300 per Audit Committee meeting. Effective March 1, 2004,

each disinterested trustee is paid $2,500 per Board meeting that they attend in

person and $1,500 per Board meeting that they attend telephonically. Effective

March 1, 2004, each disinterested trustee is paid $500 per Audit Committee

meeting that they attend in person and $300 per Audit Committee meeting that

they attend telephonically.

15

The table below illustrates the compensation paid to each trusteeAdvisor $150,000 for the Trust'sservices of the chief compliance officer. For the fiscal year ended October 31, 2003.2014, the Trust paid the “disinterested” Trustees an aggregate of $566,000. Each disinterested Trustee received $20,000 per Board meeting attended in person or via telephone, $3,000 per special Board meeting attended and $2,500 per Audit Committee meeting attended in person or via telephone. The Audit Committee Chairman and the Trustee serving on the Trust’s Valuation Committee were each paid an additional $2,500 per quarter. The disinterested Trustees’ compensation is allocated by the Funds’ average net assets. See the Compensation Table

Table.

Name of Person, Position | Aggregate Compensation from Trust | Pension or Retirement Benefits Accrued as Part of Trust Expenses | Estimated Annual Benefits Upon Retirement | Total Compensation from Trust and Fund Complex Paid to Trustees | ||||||||||||

Charles W. Caulkins, Trustee | $ | 91,000 | $ | 0 | $ | 0 | $ | 91,000 | ||||||||

Alexander Douglas, Trustee | $ | 91,000 | $ | 0 | $ | 0 | $ | 91,000 | ||||||||

Charles F. Gauvin* | N/A | N/A | N/A | N/A | ||||||||||||

James W. Gerard, Trustee | $ | 101,000 | $ | 0 | $ | 0 | $ | 101,000 | ||||||||

William F. Indoe, Trustee | $ | 91,000 | $ | 0 | $ | 0 | $ | 91,000 | ||||||||

Robert W. Kleinschmidt, Trustee | $ | 0 | $ | 0 | $ | 0 | $ | 0 | ||||||||

Guy A. Main, Trustee** | $ | 101,000 | $ | 0 | $ | 0 | $ | 101,000 | ||||||||

William J. Nolan III, Trustee | $ | 91,000 | $ | 0 | $ | 0 | $ | 91,000 | ||||||||

François D. Sicart, Trustee | $ | 0 | $ | 0 | $ | 0 | $ | 0 | ||||||||

| * | Mr. Gauvin is not currently a Trustee of |

| ** | Mr. Main retired as a Trustee of the Trust |

11

Officers

Name, Position(s) Address(1) and Age | Term of Office and | Principal Occupation(s) During Past Five Years | ||

Helen Balk (41) Treasurer | Indefinite Term, Since 2014 | Controller / Treasurer of Tocqueville Asset Management from January 2014 to present; Manager / Staff Accountant at Pegg & Pegg LLP from August 1995 to January 2014. | ||

Elizabeth Bosco (66) Anti-Money Laundering Compliance Officer | Indefinite Term, Since 2009 | Chief Compliance Officer of Tocqueville Securities, L.P. from January 2009 to present; Compliance Officer, Tocqueville Securities L.P. and Tocqueville Asset Management from January 1997 to January 2009. | ||

Robert W. Kleinschmidt (65) President | Indefinite Term, Since 1991 | President and Chief Investment Officer of Tocqueville Asset Management; Director, Tocqueville Management Corporation, the General Partner of Tocqueville Asset Management L.P. and Tocqueville Securities L.P. from January 1994 to present; and Managing Director from July 1991 to January 1994; Partner, David J. Greene & Co. from May 1978 to July 1991. | ||

Cleo Kotis (39) Secretary | Indefinite Term, Since 2010 | Director of Operations, the Delafield Group of Tocqueville Asset Management L.P., 2009 to present; Vice President and Chief Operating Officer, the Delafield Fund, | ||

Thomas Pandick (67) Chief Compliance Officer | Indefinite Term, Since 2004 | Chief Compliance Officer (October 2004 to present) Tocqueville Asset Management L.P. | ||

François D. Sicart (70) Chariman | Indefinite Term, Since 1987 | Chairman, Tocqueville Management Corporation, the General Partner of | ||

| (1) | Address: 40 West 57th Street, 19th Floor, New York, New York, 10019, unless otherwise noted. |

| (2) | Each officer will hold office for an indefinite term or until the date he or she resigns or retires or until his or her successor is elected and qualified. |

12

Quorum and Voting

Each holder of a whole Share shall be entitled to one vote for each such whole Share, and each holder of a fractional Share shall be entitled to a proportionate fractional vote for each such fractional Share, held in such shareholder’s name. Shares of each Fund issued and outstanding as of the Record Date are indicated in the following table:

Fund | Number of Shares | |||

The Tocqueville Fund | 11,531,413 | |||

The Tocqueville Opportunity Fund | 3,615,602 | |||

The Tocqueville International Value Fund | 16,487,730 | |||

The Tocqueville Gold Fund | 37,179,088 | |||

The Delafield Fund | 7,887,159 | |||

The Tocqueville Select Fund | 40,798,149 | |||

The Tocqueville Alternative Strategies Fund | 1,508,274 | |||

Total | 119,007,415 | |||

If you are not the owner of record, but your Shares are instead held for your benefit by a financial intermediary such as a retirement plan service provider, broker-dealer, bank trust department, insurance company or other financial intermediary, that financial intermediary may request that you instruct it how to vote the Shares you beneficially own. Your financial intermediary will provide you with additional information.

If you hold Shares of a Fund through a bank or other financial institution or intermediary (called a service agent) that has entered into a service agreement with the Fund or a distributor of the Fund, the service agent may be the record holder of your Shares. At the Meeting, a service agent will vote Shares for which it receives instructions from its customers in accordance with those instructions. A signed proxy card or other authorization by a shareholder that does not specify how the shareholder’s Shares should be voted on a proposal may be deemed to authorize a service provider to vote such Shares in favor of the applicable proposal. Depending on its policies, applicable law or contractual or other restrictions, a service agent may be permitted to vote Shares with respect to which it has not received specific voting instructions from its customers. In those cases, the service agent may, but may not be required to, vote such Shares in the same proportion as those Shares for which the service agent has received voting instructions. This practice is commonly referred to as “echo voting.”

Shareholders of the Trust will vote collectively on the election of the Trustee Nominees. The presence in person or by proxy of a majority of the Trust’s Shares that are entitled to vote constitutes a quorum. The Trustee Nominees must receive a plurality of the votes cast in person or by proxy at the Meeting at which a quorum exists, which means that the eight Trustee Nominees receiving the highest number of affirmative votes cast at the Meeting will be elected. In the event that the necessary quorum to transact business is not obtained at the Meeting with respect to the Trust as to one or more Funds, as applicable, the persons named as proxies may propose one or more adjournments of the Meeting, in accordance with applicable law, to permit further solicitation of proxies with respect to the Proposal. Any such adjournment as to a matter will require the affirmative vote of the holders of a majority of the Shares of the Trust or the applicable Fund, present in person or by proxy at the Meeting. The persons named as proxies will vote the proxies (including broker non-votes and abstentions) in favor of adjournment if they determine additional solicitation is warranted and in the interests of shareholders of the Trust or the applicable Fund.

“Broker non-votes” are Shares held by a broker or nominee for which an executed proxy is received by the Trust, but are not voted as to the Proposal because instructions have not been received from beneficial owners or persons entitled to vote and the broker or nominee does not have discretionary voting power. For purposes of determining the presence of a quorum for transacting business at the Meeting, abstentions and “broker non-votes” are treated as Shares that are present, but will not be voted for or against any adjournment or the Proposal. Abstentions and “broker non-votes” will not be counted in favor of, but will have no other effect on, the Proposal, for which the required vote is a plurality (the greatest number) of the votes cast.

13

The Board of Trustees, including all of the Independent Trustees, recommends that shareholders of each Fund voteFOR each Trustee Nominee identified in the Proposal.

ADDITIONAL INFORMATION

Fund Service Providers

Investment Adviser and Administrator

Tocqueville Asset Management L.P.,, with principal offices at 40 West 57th Street, 19th Floor, New York, New York 10019, serves as the investment adviser of each Fund pursuant to investment advisory agreements and serves as the administrator for each Fund pursuant to administration agreements.

Distributor

Tocqueville Securities L.P. (the “Distributor”), with principal offices at 40 West 57th Street, 19th Floor, New York, New York 10019, serves as the Distributor of each Fund’s Shares pursuant to a distribution agreement.

Sub-administrator

U.S. Bancorp Fund Services, LLC, with principal offices at 615 East Michigan Street, Milwaukee, Wisconsin 53202, serves as the sub-administrator for each Fund pursuant to a sub-administration agreement. USBFS also serves as the Fund’s transfer agent and dividend paying agent and provides the Fund with certain fulfilment, accounting and other services pursuant to agreements.

Custodian

U.S. Bank National Association, with principal offices at 1555 NorthRiver Center Drive, Suite 302, Milwaukee, Wisconsin 53212, serves as the custodian of the Funds’ assets pursuant to a custody agreement.

Independent Registered Public Accounting Firm

Grant Thornton LLP (“GT”) serves as the Trust’s independent registered public accounting firm. GT provides audit services, tax return review and assistance and consultation in connection with review of SEC filings. GT is located at 175 W. Jackson Blvd., 20th Floor, Chicago, Illinois 60604-2687. Representatives of GT are not expected to be present at the Meeting.

The following tables set forth, for the Trust’s two most recent fiscal years, the fees billed by GT for (a) all audit and non-audit services provided directly to the Trust and (b) those non-audit services provided to the Adviser and any entity controlling, controlled by or under common control with the Adviser that relate directly to the Funds’ operations and financial reporting:

Fiscal Year Ended | Audit Fees | Audit –Related Fees | Tax Fees | All Other Fees | ||||||||||||

October 31, 2014 | $ | 206,000 | $ | 0 | $ | 27,000 | $ | 0 | ||||||||

October 31, 2013 | $ | 156,000 | $ | 0 | $ | 21,500 | $ | 0 | ||||||||

14

“Audit Fees” represents fees billed for each of the last two fiscal years or professional services rendered for the audit of the Trust’s annual financial statements for those fiscal years or service that are normally provided by the accountant in connection with statutory or regulatory filings or engagements for those fiscal years. “Audit-Related Fees” represent fees billed for each of the last two fiscal years for assurance and related services reasonably related to the performance of the audit of the Trust’s annual financial statements for those years. “Tax Fees” represent fees billed for each of the last two fiscal years for professional services related to tax compliance, tax advice and tax planning, including preparation of federal and state income tax returns, review of excise tax distribution requirements and preparation of excise tax returns. “All Other Fees” represent fees, if any, billed for other products and services rendered by GT for the last two fiscal years.

Pre-Approval Policies and Procedures

The Trust’s Audit Committee Charter provides that the Audit Committee (comprised of the Independent Trustees of the Trust) is responsible for pre-approval of all auditing services performed for the Trust. The Audit Committee report to the Board regarding its approval of the engagement of the auditor and the proposed fees for the engagement, and the majority of the Board (including the members of the Board who are Independent Trustees) must approve the auditor at an in-person meeting. The Audit Committee also is responsible for pre-approval (subject to thede minimis exception for non-audit services described in the Securities Exchange Act of 1934, as amended, and applicable rule thereunder) of all non-auditing services performed for the Trust or for any service affiliate of the Trust. The Trust’s Audit Committee pre-approved all fees described above which GT billed to each Fund within the Trust.

Share Ownership

A principal shareholder is any person who owns of record or beneficially 5% or more of the outstanding Shares of a Fund. A control person is one who owns beneficially or through controlled companies more than 25% of the voting securities of a company or acknowledges the existence of control. Shareholders with a controlling interest could affect the outcome of voting or the direction of management of a Fund.

As of July 31, 2004,December 19, 2014, the AdviserAdvisor held discretion over shares of the Funds as follows:

The Tocqueville Fund 19.80%.

The Tocqueville Small Cap Value Fund 16.99%.

The Tocqueville International Value Fund 68.60%.

The Tocqueville Gold Fund 6.24%.

The Tocqueville Genesis Fund 30.89%.

The Tocqueville Fund | 12.16 | % | ||

The Tocqueville Opportunity Fund | 54.13 | % | ||

The Tocqueville International Value Fund | 31.98 | % | ||

The Tocqueville Gold Fund | 0.63 | % | ||

The Delafield Fund | 1.06 | % | ||

The Tocqueville Select Fund | 14.38 | % | ||

The Tocqueville Alternative Strategies Fund | 48.68 | % |

As of July 31, 2004, the trustees and officers as a group owned

beneficially 2.25% of the Tocqueville Fund's outstanding shares and less than 1%

of the outstanding shares of each of the other Funds.

As of July 31, 2004,December 19, 2014, the following shareholders owned of record or beneficially 5% or more of each Fund'sFund’s shares:

The Tocqueville Fund

Name and Address | Parent Company | Jurisdiction | % Ownership | Type of Ownership | ||||||

Pershing LLC 1 Pershing Plaza Jersey City, NJ 07399-0002 | Pershing Group LLC | DE | 32.58 | % | Record | |||||

Charles Schwab & Co., Inc. Attn: Mutual Funds 211 Main Street San Francisco, CA | N/A | N/A | 28.43 | % | Record | |||||

National Financial Services Corp. One World Financial Center 200 Liberty New York, NY 10281-1003 | N/A | N/A | 6.08 | % | Record |

15

The Tocqueville Opportunity Fund

Name and Address | Parent Company | Jurisdiction | % Ownership | Type of Ownership | ||||||

Pershing LLC 1 Pershing Plaza Jersey City, NJ 07399-0002 | Pershing Group LLC | DE | 72.43 | % | Record | |||||

Charles Schwab & Co., Inc. Attn: Mutual Funds 211 Main Street San Francisco, CA | N/A | N/A | 5.68 | % | Record | |||||